A longtime client recently found themselves financially upside down when a new company vehicle was involved in an accident and declared a total loss. They had borrowed heavily to purchase the vehicle and discovered they owed $4,400 more than the vehicle was worth.

How Upside Down Happens

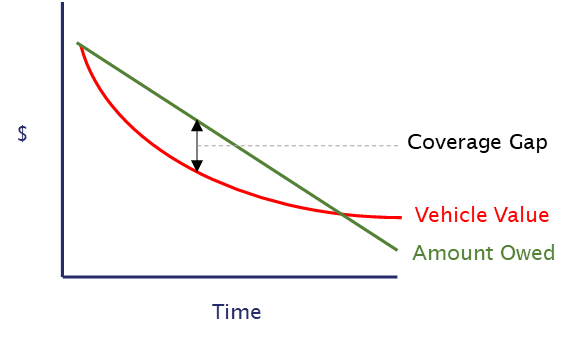

An avid car collector once said, “Vehicles are a terrible investment.” He realized his passion for autos was simply a hobby because most vehicle values decrease over time. As such, most insurance policies pay claims based on the market value of the vehicle just prior to the accident.* However, because a vehicle’s value diminishes most rapidly when it is newest, as in the case of our client, a significant difference in value can exist between what is owed and its current value, creating a gap in coverage.

This coverage gap can occur no matter whether you own the vehicle and borrowed money for its purchase, or whether you lease. It can occur on new or used vehicles. Most surprisingly, it can even happen no matter which party was at fault. To be clear, just because someone else damages your vehicle means they are obligated to replace or repair your vehicle, not pay off your loan.

Insurance Pays

Insurance companies recognized this issue many years ago and began offering GAP coverage. GAP coverage is just that, the promise to pay the difference between what is owed and the vehicle’s value. OK, technically GAP stands for Guaranteed Asset Protection (GAP), but it is easier to understand by explaining how it fills a coverage gap. But for those insurance industry folks who are sticklers for detail, Guaranteed Asset Protection it is.

In the case of our client, they initially assumed the $4,400 coverage gap would come out of their own pocket until their Bankers Insurance claims agent took the time to study their policy. In doing so, they discovered it contained a GAP coverage endorsement (add-on) and were able to secure the additional $4,400 for our client.

Setting the Record Straight

A fundamental misunderstanding exists regarding the insurance industry. By and large insurance companies WANT to pay claims. Yes, you read that correctly. They make money only by keeping clients happy for the long run and honoring their commitments. Claim time is when they prove their value to their client and strengthen that relationship. Successful insurance companies recognize this, respond quickly, and pay what is due.

David McCaleb LinkedIn

Bankers Insurance LLC

* Other valuation methods exist, such as agreed value. Agreed value is more common on business auto policies, but the values for each vehicle should be reviewed and updated every policy term. Agreed value can be an option on certain specialty personal auto policies, such as for antique autos or exotic vehicles.

Comments are closed.