BY: Mike Barnum, CIC, President’s Club

mbarnum@bankersinsurance.net | (757) 589-9493

![]()

“I pay all this premium year after year and don’t have claims. Why are my insurance costs not lower?”

I answer this question from businesses several times a week, and it’s a valid inquiry. Some agents may answer that question by explaining that insurance companies have expenses too. While that may be true, it doesn’t explain the deeper issue of community rating and the savings offered by its more attractive counterpart: individual rating.

Community Rating

Although one business may have no claims in any given year, it is likely at least a few policy holders in the same industry did. The insurance company pools everyone’s insurance premiums to pay for these claims. Thus, the business with low claims pays for insurance costs of other businesses which may not have as good of a safety record.

What if I told you that there are strategies to help insulate yourself from these claims of other businesses and stop being pulled down by their poor record?

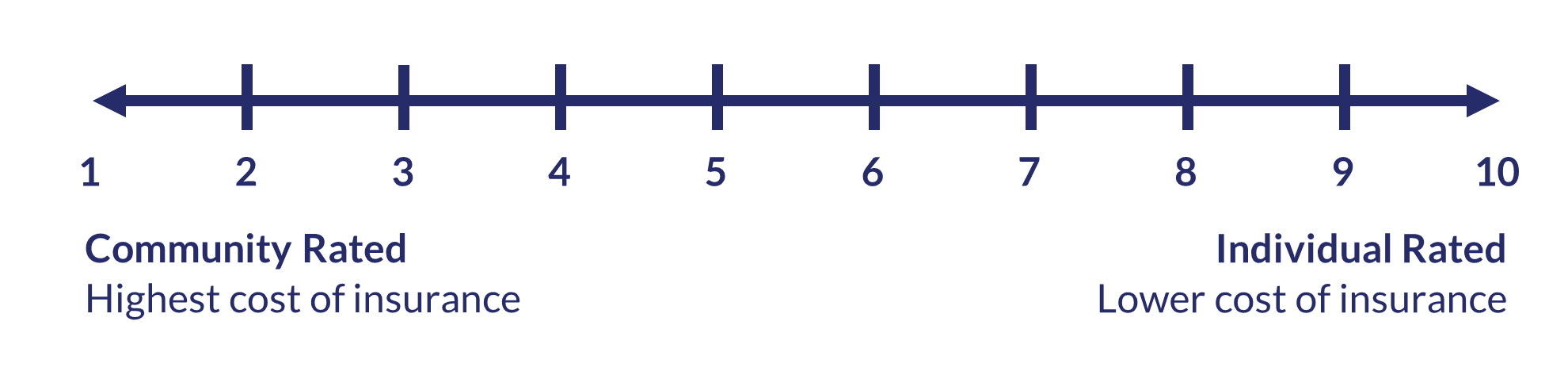

But first a quick exercise. Rate your business on a scale of 1 to 10.

- 1 represents the bad: the highest cost of risk and 100% community rated. Such businesses provide little information to the insurance company about their business, do not invest in risk reduction strategies, are ignorant of how their insurance program compares to high performing companies, and simply buy insurance because they must.

- 10 represents the good: a business that is confident they are buying insurance at low cost, utilizes modern means to proudly showcase themselves to the insurance companies, reduces risk at every opportunity, and regularly looks for strategies to lower cost.

Where would your business fall? Both are extremes and most businesses lie somewhere in between. However, higher ranking businesses distance themselves from their industry’s poor performers and move towards having their insurance program be rated on an individual basis by insurance companies, thereby saving money.

Separating Oneself from the Pack

Though separating yourself from the industry in the eyes of insurance companies can be challenging, with the right insurance broker there is an easy track. By executing certain strategies and documenting progress, a business distances itself from community rating and insurance costs are better calculated based upon the individual business. If done correctly, this means lower costs. Below are a few examples of breakout strategies and data points of which to be aware.

Loss Ratio

Each business has a loss ratio, which is the percentage of claims paid versus insurance premiums paid. If the business had $20,000 in claims and paid $100,000 in insurance premium, the loss ratio is 20%. For the math majors, loss ratio = ($ in claims) ÷ ($ in insurance premium). This is simply a data point, but an important one because risk reduction strategies should evidence themselves by lowering the loss ratio from year to year.

Most insurers view a 50% loss ratio as the breakeven point. If below that, the business is considered a profitable client. If above, the business is costing the insurance company too much. How? Remember that managing an insurance company is costly (payroll, buildings, infrastructure, reinsurance), and at any time they must have the financial reserves at the ready to pay out large claims for any client. A 50% loss ratio is the insurance company’s cost of goods sold, and they can’t sell their product for less than it costs them.

Knowing loss ratios enables businesses to understand how much leverage they have over insurance companies, and how they are viewed. I recommend starting with calculating a one-year, three-year, and five-year loss ratio. They can also be calculated by each coverage (workers compensation, business auto, general liability) to illustrate performance in specific areas. Lower loss ratios provide your business more negotiating power with insurance companies regarding pricing. But now, what strategies can be employed to get loss ratios lower? That’s where the loss modeling comes in.

Loss Modeling

Loss modeling is a means to present claims in the best light to insurance companies. Have you had a past claim strain your company and, as a result, determined not to let it happen again? If so, that is valuable knowledge. How well did you communicate these changes and improvements to the insurance company? Many businesses do not investigate the root cause of a claim and document the ways they adjust to reduce the risk of a repeat. Through inaction, they miss an opportunity and insurance companies will forecast claims based upon the only information they have – claims history. Alternatively, by communicating changes made, insurance companies now have a reason to discount the weight of a past claim.

Good insurance brokers know how insurance companies view claims. They review claim history with their clients, document any root cause analysis performed along with changes implemented, then put it all into a loss modeling format to articulate this story in the best light. A simple example would be if a prior employee with multiple at-fault accidents is no longer employed, this should be documented along with how hiring standards were improved so that an employee with similar characteristics will not be hired again, then presented to the insurance company.

Predictive Analytics

Has your business ever received quotes from multiple insurance companies, but the pricing was vastly different? This is because insurance companies use different means to identify a good business risk from a bad one. These analytics are like their “special recipe”, a proprietary way of rating clients. And though insurance companies do not share their recipe, they often have similar ingredients. Thus, if a business does not provide the data points (ingredients) needed, it won’t go into the recipe and assumptions will be made. Whatever ingredients insurance companies don’t know, they substitute with premium.

Good insurance brokers understand this perspective and utilize predictive analytics to their client’s advantage. They help identify credits deserved for risk management work being done by the client. They know what insurance companies look for – the ingredients – and make recommendations to their client on how to improve. They present these findings and actions taken to insurance companies, growing in their confidence, and receiving better pricing.

Alternative Underwriting Models

If claims are low and a business is paying over $100,000 per year in insurance premium, opportunities exist to further distance oneself from community rating and participate in alternative underwriting models which present an opportunity to receive back up to 50% of insurance premiums for low claims. A few options include risk retention groups and captive insurance, both of which pay dividends back to the business for low claims. With a strong claims record, these models typically prove to be the lowest cost options available.

Risk Improvement Strategies

Targeted risk improvement strategies should be leveraged each year. What is the business’s one-year and three-year plan to reduce risk? Defining it and writing it down could even help lower insurance costs today. Improving safety plans, procedures, and handbooks, along with addressing risk transfer language and agreements, are examples of opportunities to lower risk and reduce insurance cost. Analyzing claims with your insurance broker, experience modification analysis (workers compensation), improving safety culture through safety meetings and providing incentives and/or accountability all improve a business’s story and yield lower insurance costs.

At Bankers Insurance, we believe each business should have a strategy and executable plan to improve their insurance costs today, tomorrow, and beyond. For those not satisfied with paying for other business’s claims in a community rating system, that’s why you have an insurance broker – to understand the details and lead you to higher ground. Through our Full Circle Experience, we apply a structured approach to rate businesses on the community/individual rating scale and apply strategies to get them closer to a ten, reducing risk and expense.

Interested? Contact us for a complementary risk review.

BY: Mike Barnum, CIC, President’s Club

Risk Advisor – Business Insurance

mbarnum@bankersinsurance.net | (757) 589-9493

Was this post helpful?

- Share it using the links below

- Review all our business insurance posts

- Review all our business insurance products

- Subscribe

Comments are closed.