By: Mandy Staton | Personal Insurance Risk Advisor

mstaton@bankersinsurance.net | (540) 707-2109

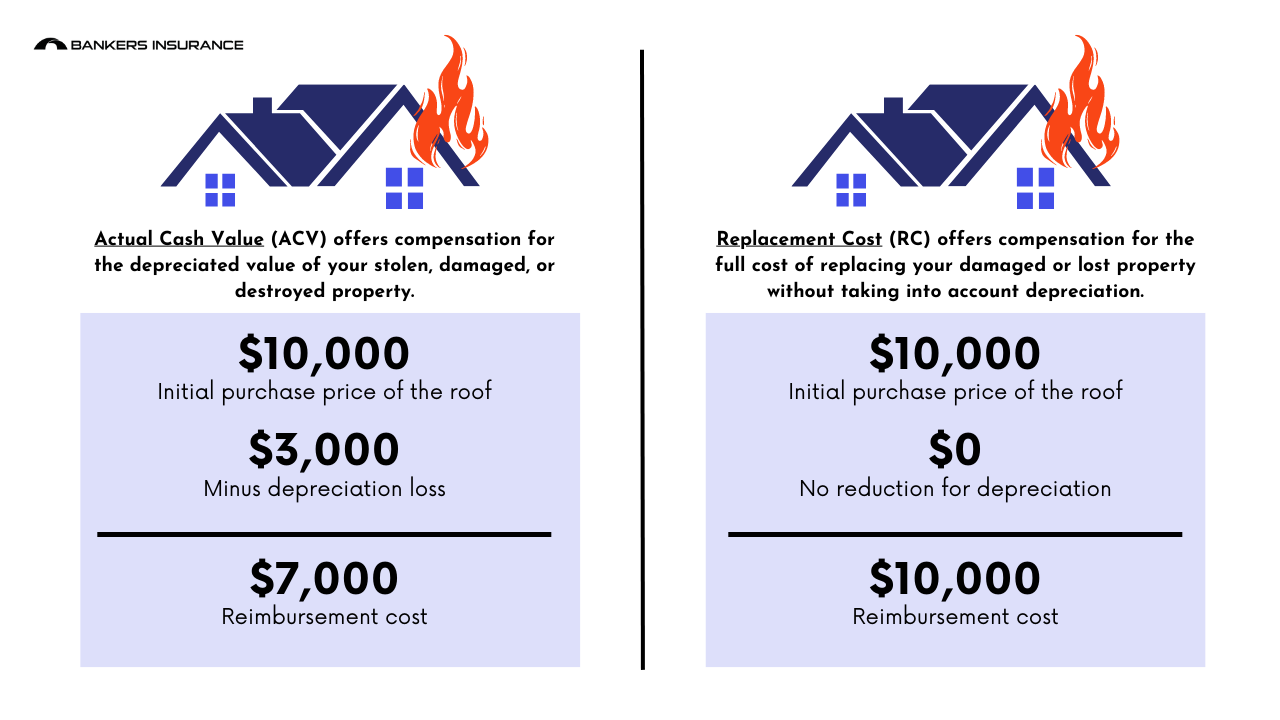

When it comes to insurance coverage for your property, there are two terms that you need to be familiar with: Actual Cash Value (ACV) and Replacement Cost (RC). While both of these terms are used to determine the value of your property in case of a loss, they are calculated differently and can have a significant impact on the amount of coverage you receive. Let’s take a closer look at the differences between ACV and RC, and why it’s important to understand these distinctions to ensure that you have the right insurance coverage for your needs.

What is Actual Cash Value?

Actual Cash Value (ACV) is a coverage option that can offer compensation for the depreciated value of your stolen, damaged, or destroyed property. This means that the payout you receive may not cover the full cost of replacing your damaged or lost item with a new one. Instead, that value is determined by the age, condition and expected remaining useful life of your property. For example, if your roof was damaged in a storm and needed to be replaced, you would be compensated for the current market value of the roof based on its age, condition, and remaining useful life, rather than the full cost of replacing it with a new roof. If you installed the roof several years ago for $10,000, you will only be reimbursed a portion of your loss due to depreciation. It’s important to keep in mind that ACV typically provides less coverage and costs less.

What is Replacement Cost?

Replacement Cost (RC) offers coverage for the full cost of replacing your damaged or lost property with a new item of similar kind and quality, without taking into account depreciation. This means that if you have a claim and your policy uses RC, you will receive enough money to replace your damaged or lost item with a new one. While RC coverage may result in higher premium costs compared to ACV coverage, it can offer greater peace of mind and financial protection in the event of a loss. However, it is important to note that RC coverage is subject to the limits on the policy.

Ultimately, choosing between actual cash value (ACV) and replacement cost (RC) coverage depends on your individual needs and circumstances. ACV may offer lower premiums, but it provides less coverage and only compensates for the depreciated value of your damaged or lost property. RC on the other hand, offers full replacement cost coverage and can provide greater financial protection, but typically comes with higher premiums. When deciding between the two, it’s important to consider the value of your belongings, the potential cost of replacing them, and whether you intend to replace the items should they get damaged, lost or stolen.

It’s best to work with a trusted insurance agent or broker to determine which coverage option is right for you and to ensure that you have adequate coverage to protect your assets in the event of a loss. If you are interested in connecting with one of our agents to discuss your insurance needs and explore your coverage options, please don’t hesitate to contact us. We’re here to help you find the right coverage and provide the peace of mind you deserve.

Was this post helpful?

- Share it using the links below

- Review all our personal insurance posts

- Review all our business insurance posts

- Subscribe

Thinking about changing my insurance carrier. Would like to know if Bankers Insurance insures Mobile Homes. I have our auto insurance through Bankers, but our home is through Foremost Insurance.

Hi Bill, thank you for reaching out! We will have your Bankers Insurance auto insurance account manager reach out to discuss potentially a quote for your mobile home. All the best!